Customer case study – Seatrade

Richard Tiggelaar, Team Leader Accounting talks about Seatrade’s experience with MarTrust

Why Seatrade Maritime chose MarTrust

In this interview, Richard explains how implementing the MarTrust E-Wallet has saved invaluable time for Seatrade, allowing them to focus on what they do best.

Reduced workload

MarTrust: What did you do before you started using the MarTrust E-Wallet, and how is it different now?

Richard: We created a payroll, and seafarers requested an allotment every month, sometimes the allotments and the bank accounts from the seafarers differ.

We were spending a lot of time creating the payments for wages every month. MarTrust reduced the workload a lot.

There was still some communication, but more communication between MarTrust and us, than us and the seafarer.

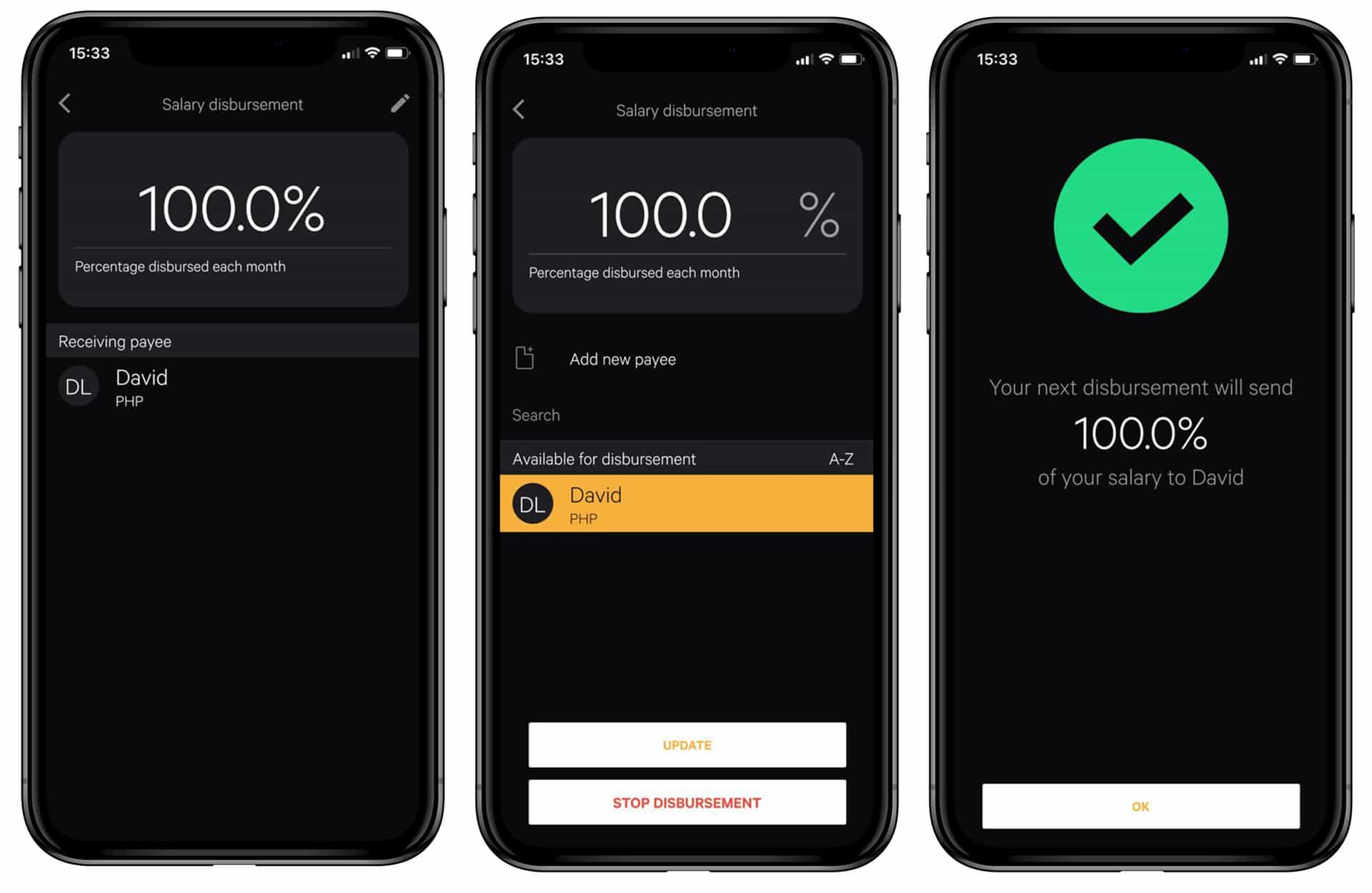

The seafarer can access his app and the E-Wallet as he wants to, so that is perfect.

Quick to upload and schedule the payroll

MarTrust: What do you like the most about the MarTrust E-Wallet?

Richard: Actually, how quick it is to upload the payroll, schedule the payroll, and make any necessary approvals. You can also easily add users and super users.

Positive feedback from seafarers

MarTrust: What are some of the benefits you hear directly from the seafarers?

Richard: The feedback we receive is mainly positive because they can add bank accounts, and they can transfer funds from their own MarTrust E-Wallet to an E-Wallet of a colleague.

These are some of the benefits that we hear.

Seafarers are in full control of their funds

MarTrust: What are the overall benefits for Seatrade?

Richard: For the company, it is timesaving and for the seafarers, they are completely in control of their own funds and that is a huge benefit for them.

Seafarers can make remittances to any bank account they wish, pay with their MarTrust cards to make offline and online payments, and do ATM withdrawals, so for the seafarers, there are lots of benefits.

We mainly work with Russian, Ukrainian, and Filipino crew members, we are now rolling the MarTrust solution out fleet-wide for our Russian and Ukrainian crew members.

If that goes well, we are also looking to roll it out to the Filipino crew members.

Saves the company in reduced bank charges

MarTrust: With MarTrust E-Wallet and card, cash to master is digitalised. Can you share your views?

Richard: With the Cash to Master deliveries on board, there are also huge bank charges and for our company, these can be the value of about $100,000 per year, only for the bank charges to deliver cash on board.

If the cash can be reduced there, you will have a lot of savings from bank charges alone.

We have a lot of vessels sailing in West Africa into West African ports, their safety also becomes a big issue, it is important not to have too much cash on board.

Remitting wages

MarTrust: How will a payment solution like MarTrust help seafarers worldwide and your company?

Richard: I think it brings home closer to the seafarer when he is out on the sea.

For example; if a wife of a seafarer needs some money urgently, that can be done within seconds and the money can be sent to the account of or be on the card of the partner of the seafarer almost instantly.

So for the seafarer, it brings home a little closer to him.

The MarTrust solution for the company allows us to have better cash flow control, which is the main reason for doing this.

Cash flow saves time so as a company you can do things that you are good at. Remitting wages is not your core business as a shipping company, so, therefore, you can bring the business back where it belongs.

Onboarding went very smoothly

MarTrust: Share your experience with MarTrust’s onboarding process.

Richard: The onboarding process went very smoothly. We had to deliver many documents, but that has to do with safety as you are dealing with the wages of the seafarers. As you have to give the required documents to a third party, you want to have trust.

The onboarding process went very smoothly for us.

Hear from other customers…

“We are saving funds in hundreds of thousands of dollars per year” – ABC Maritime

“Now the captain has his MarTrust card onboard, which he can utilise for vessel needs, this is saving $8,000-10,000 per year [and per vessel] on fees that we pay to the port agents.”

George explains how implementing the MarTrust e-wallet has saved hundreds of thousands of dollars for ABC Maritime, and that it provides the ability for seafarers to instantly receive and send funds at competitive FX rates.

“Sending funds to colleagues is very easy. I sent money to my 3rd engineer, and he received it in 1-2 minutes.”

Captain Villavicencio explains how the MarTrust E-Wallet enables him to send funds to crew members at the push of a button and removes seafarers’ need to have to wait until they’re onshore to send money home using expensive remittance services.