Trusted by over 50,000 crew worldwide to manage their money

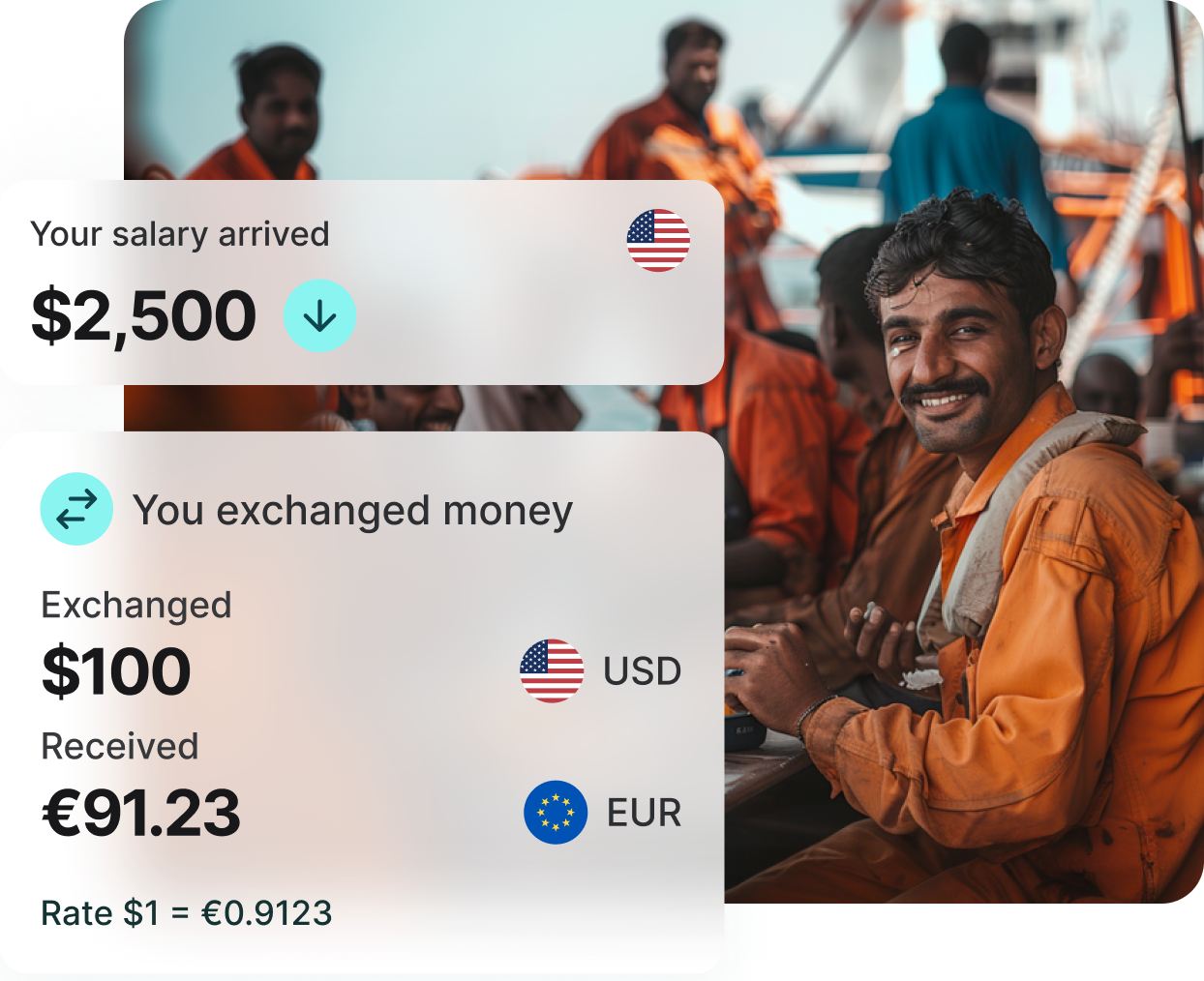

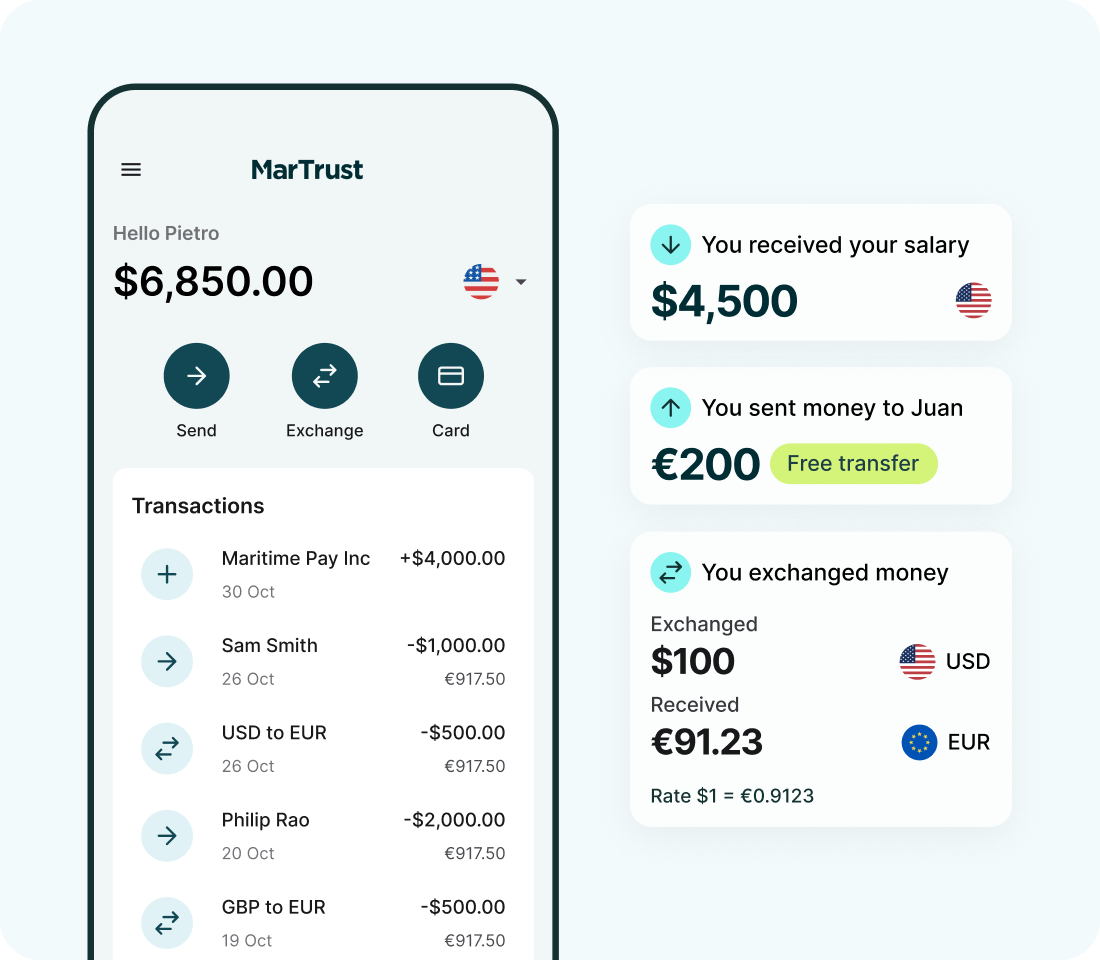

Send money home fast, for less

Take full control of your salary and reduce transfer fees when you get paid to your free MarTrust Account.

- Receive instant salary payments

- Send money globally to over 150 countries in more than 135 currencies

- Exchange currencies at competitive rates, from 1%

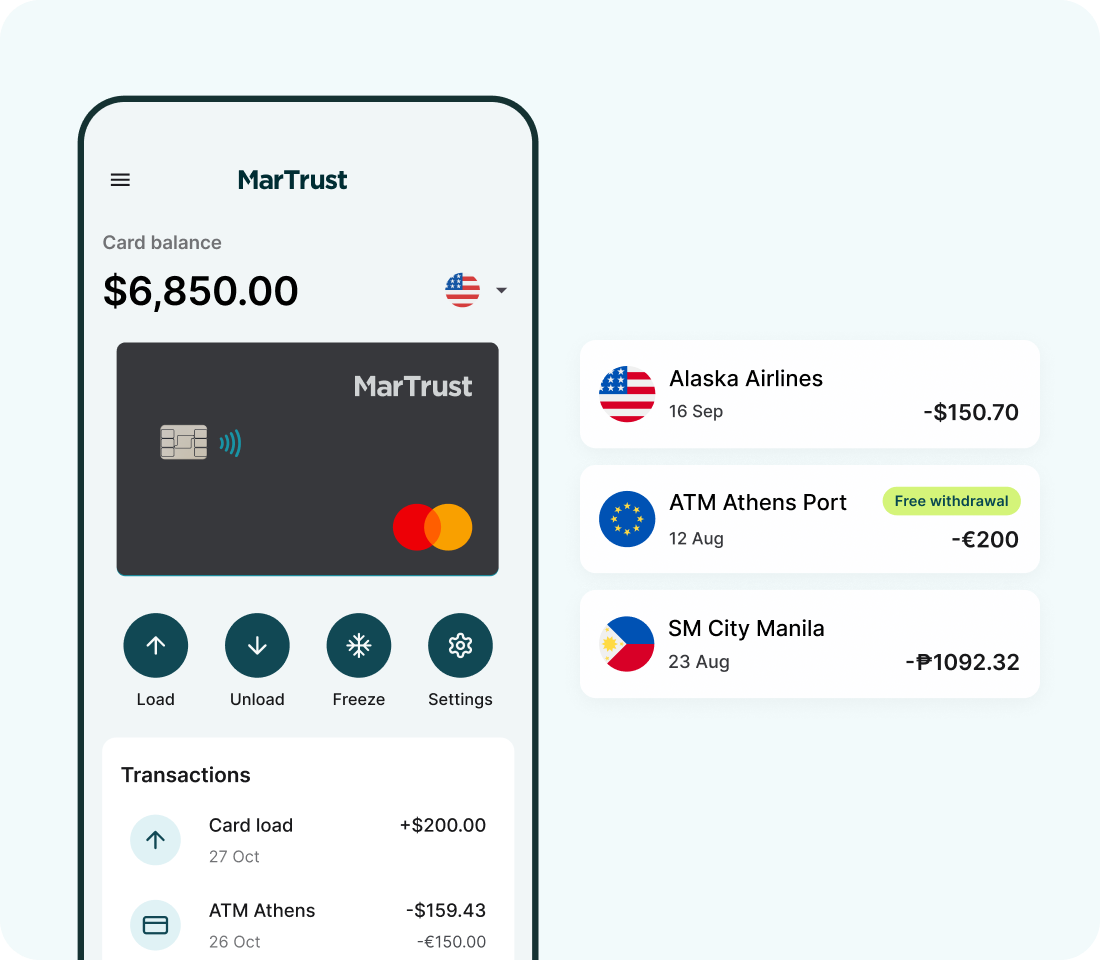

Spend like a local, from port to port

The MarTrust Debit Mastercard means there’s no need to buy currency when you arrive in port.

- Globally accepted debit card

- Spend in any currency with instant conversion at competitive exchange rates

- Hold a separate card balance to keep funds secure from your main account

We take your security seriously

We have over 20 years of maritime payments expertise and are trusted by over 500 shipping companies and 50,000 crew to manage their money.

- Partnering with Mastercard and Monavate

- Regulated by the UK Financial Conduct Authority

- Fraud protection with Mastercard Securecode

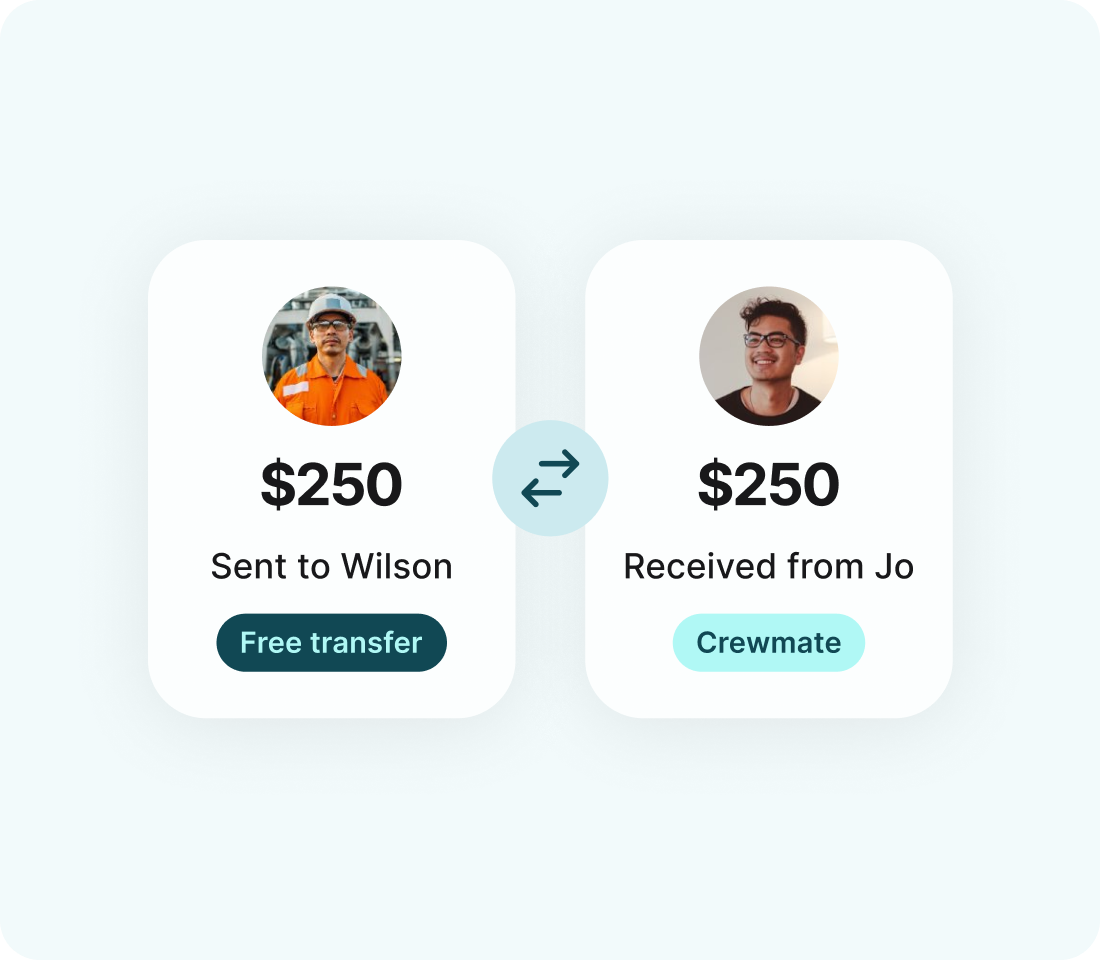

Free Crew-to-Crew transfers

No need to pay your crewmates in cash – send money to anyone using MarTrust.

- Instant, free transfers between crewmates

- Reduce the need to hold cash onboard

- The most convenient way to pay your crewmates

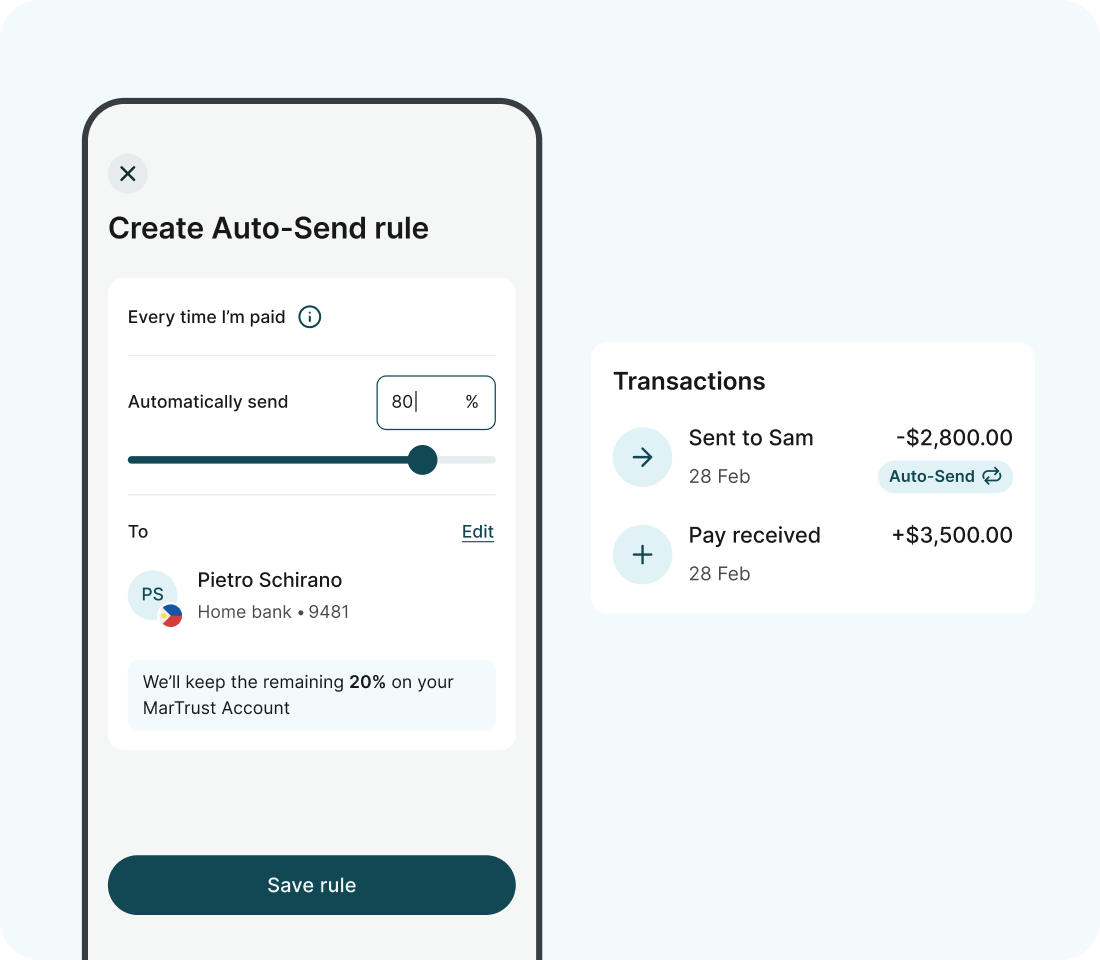

Automate money transfers with Auto-Send

Automatically send money to a recipient every time you’re paid by your employer.

- Avoid payment delays – transfers are sent as soon as you’re paid.

- Stay in control – choose how much to send, the recipient, and update or delete rules anytime.

- Peace of mind at sea – transfers happen even without internet access.

What crew say about MarTrust

Ask your employer to get paid with MarTrust

If your employer is using MarTrust, you can ask them to set up your MarTrust Account. Once your employer gets in touch with us, we’ll send you an email invitation to register.

Features coming soon

More account currencies

Google Pay and Apple Pay

Virtual cards

We’re here to help

For any questions regarding the MarTrust Account

or the latest account information, visit our help centre or get in touch.

We offer support in English, Tagalog and Russian.